Weekly Market Commentary

By Andrew Tang

FOR INFORMATIONAL AND EDUCATIONAL USE ONLY

Notes for January 31, 2022

So the Fed is going to raise interest rates right? Well.....

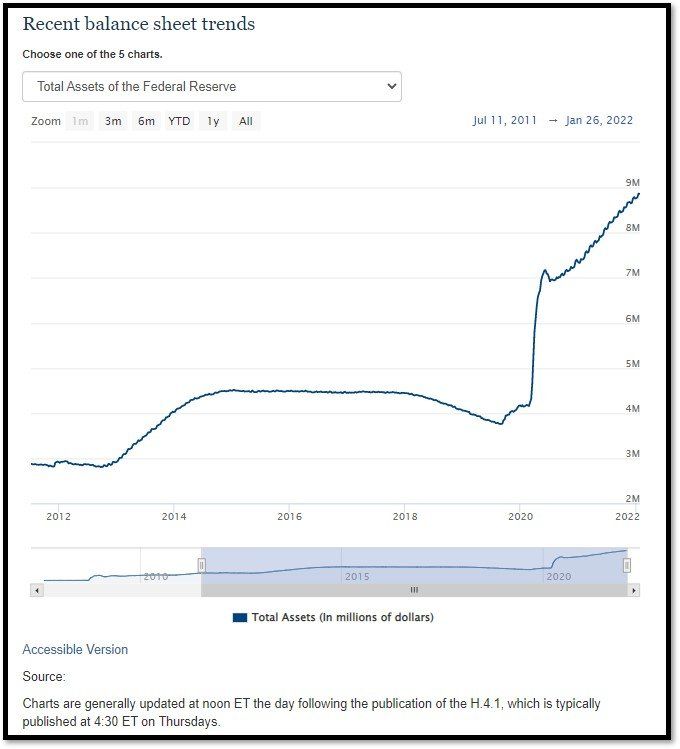

1. This week, I would like to highlight the idea of Fed’s reduction of its balance sheet… So much so that the effect may be enough to hold off on the expected aggressive rate hikes this year and 2023. Sounds too optimistic or bullish for the stock market? Perhaps not. The Federal Reserve can move sooner to start reducing its bond holdings than in the past and aggressive action to shrink the U.S. central bank's portfolio could allow it to take a shallower path on interest rate increases, Kansas City Fed President Esther George said on Monday. The Fed signaled last week that it is likely to start raising interest rates when it meets in March, and officials are expected to begin offloading more than $8 trillion in bond holdings later this year. George said both actions, which the Fed is taking to remove the extraordinary support provided during the pandemic, are connected. "What we do on the balance sheet is likely to affect the path of policy rates and vice versa," George said during an event organized by the Economic Club of Indiana. "For example, if we took more aggressive action on lowering, pulling down that balance sheet, it might allow for fewer interest rate increases." George said a different approach in which the central bank pairs a "steep path" for rate increases with more modest reductions to the balance sheet could lead to more financial risks. REF: FED, FedStatisicalReport, REUTERS

2. The U.S. economy last year grew at its fastest pace since 1984, but that momentum isn’t carrying into 2022. An inventory build fueled most of the second-half growth that put annualized GDP up 5.7% for the year. 70% of Q4 GDP in the U.S. was attributed to inventory rebuild. In the first quarter of this year, the economy may not show any gain at all and possibly show a loss in GDP. The pandemic, along with declining help from fiscal and monetary policy, will keep growth in check according to CNBC. The year (2022) is starting with little growth signs at all as the late-year spread of omicron coupled with the ebbing tailwind of fiscal stimulus has economists across Wall Street knocking down their forecasts for gross domestic product. Combine that with a Federal Reserve that has pivoted from the easiest policy in its history to hawkish inflation-fighters, and the picture has suddenly changed substantially. The Atlanta Fed’s GDPNow gauge is currently tracking a first-quarter GDP gain of just 0.1%. “The economy is decelerating and downshifting,” said Joseph LaVorgna, chief economist for the Americas at Natixis and former chief economist for the National Economic Council under then-President Donald Trump. “It’s not a recession, but it will be if the Fed tries to get too aggressive.” Click onto picture below to access video. REF: CNBC

3. Many clients accounts and investment portfolios hold Tesla Inc. (Ticker: TSLA) so it would be appropriate to address why the stock tumbled after profit beats estimates. Traders were looking for spectacular announcements like a new model under $25,000 or similar stories. CEO Elon Musk said Cybertruck, Semi, Roadster “hopefully” ready in 2023. The automaker’s production in 2022 will be focused on Model Y and 3 according to Bloomberg. Tesla Inc.’s shares fell after the company pushed back introductions of new models to next year, wagering the best way to continue expanding sales in the face of supply-chain challenges will be to further leverage a narrow lineup of big sellers. The world’s most valuable automaker will focus on scaling up production in 2022 to follow up what Chief Executive Officer Elon Musk called a breakthrough year both for Tesla and electric cars in general. Relying on just two vehicles -- the Model 3 and Y -- for 97% of deliveries helped alleviate challenges led by the semiconductor shortage crimping output across the car industry.

Lacking near-term additions to Tesla showrooms to promote, Musk spent much of Tesla’s earnings call discussing the potential of self-driving technology and a humanoid robot the company has under development. While Tesla has for years charged thousands of dollars for Full Self-Driving capability that it has said will live up to that name sometime in the future, the features are still in beta and humans must continue minding the steering wheel. Musk said the robot he first teased five months ago may be the most important product the carmaker is working on and has the potential to be more significant than its vehicle business. That will be a tall order, at least from an earnings perspective. Automotive revenue soared to almost $16 billion in the fourth quarter and was 90% of total sales. Profit excluding some items jumped to $2.54 a share, beating analysts’ average estimate for $2.36 a share. Tesla delivered more than 936,000 vehicles worldwide in 2021, up 87% from the year before and exceeding the 50% average annual expansion projected over several years. While Musk expects to comfortably exceed that growth again in 2022, the company warned its factories are likely to continue running below capacity through this year because of supply-chain issues. Click onto picture below to access video from Bloomberg with Dan Ives. REF: Bloomberg

Below shows Tesla’s adjusted earnings per share vs. price as of 1/27/2022. FY’22 Adj EPS +16.15% (last 4 weeks) and +65.16% (last 12 months) post Q4 earnings. Secular compounders i.e #Tesla, growing units +54% CAGR win out in the long run. Their once “rich” P/Es soon look cheap. Analyst consensus 2-year forward P/E now at just 52. REF: MovingInnovationViaTwitter

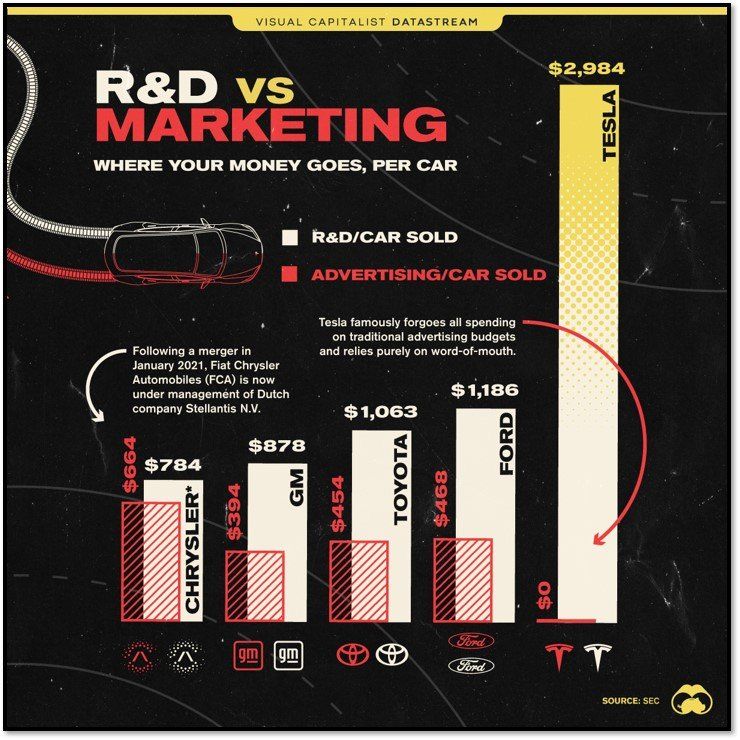

Below shows Tesla’s spending per car sold vs. other automakers. REF: Visualcapitalist

4. World Watch:

Putin Says West ‘Basically Ignored’ His Demands in Ukraine Standoff according to The Wall Street Journal – Russian leader expresses willingness to continue talks as Russian troops maneuvered near Ukraine’s borders and Kyiv rushed to bolster its defenses. “We didn’t see an adequate response to our key concerns,” Mr. Putin told reporters Tuesday at a Kremlin press conference at which he again castigated the North Atlantic Treaty Organization for what he has portrayed as a persistent eastward push that threatens Moscow. Russia has deployed roughly 100,000 troops near Ukraine, triggering alarm in Western capitals that Mr. Putin plans to invade his smaller neighbor, which he has asserted can only be truly sovereign in partnership with Russia. Mr. Putin denies any such intention. In response, Washington has outlined a series of punitive sanctions it would impose if Russia encroaches on Ukraine, stepped up shipments of military assistance to Kyiv and put thousands of soldiers on alert to defend NATO’s eastern flank in the event of a conflict. On Tuesday (2/1), Ukrainian President Volodymyr Zelensky met in Kyiv with Prime Minister Boris Johnson of Britain and Polish Prime Minister Mateusz Morawiecki, saying the three countries were working to establish a partnership that was “creating a new format of political cooperation in Europe.” Click onto picture below to access video. REF: WSJ

U.S. and Allies Seek United Front on Russia-Ukraine Crisis – NATO nations pursued talks but warned Russia of severe penalties for aggression. Washington made plans to boost European fuel supplies in case of a Russian embargo according to The New York Times. The Biden administration announced on Tuesday (1/25) that it was working with gas and crude oil suppliers from the Middle East, North Africa and Asia to bolster supplies to Europe in the coming weeks, in an effort to blunt the threat that Russia could cut off fuel shipments in the escalating conflict over Ukraine. European allies have been cautious in public about how far they would go in placing severe sanctions on Moscow if it invades Ukraine. Germany has been especially wary; it has shuttered many of its nuclear plants, increasing its dependence on natural gas imports to generate electricity. Many European officials have said they suspect President Vladimir V. Putin of Russia instigated the current crisis in the depths of winter for a reason, calculating that he has more leverage if he can threaten to turn off Russian fuel sales to Europe. Click onto picture below to access video from DW, a German public broadcast service. REF: NYT, DW

China Closely Watching Western Handling Of Ukrainian-Russian Tensions. Beijing is closely following Russia’s military buildup along its border with Ukraine, viewing it as a litmus test for political unity in the West and using the mounting tensions as an opportunity to strengthen its ties with Moscow, analysts say. In a call with U.S. Secretary of State Antony Blinken on January 27, Chinese Foreign Minister Wang Yi warned the United States and its allies not to “hype up the crisis” around Ukraine and called for a peaceful resolution to the escalating crisis, saying Russia’s “reasonable security concerns should be taken seriously.” Beijing was relatively mute amid the buildup of more than 100,000 Russian troops, but Wang’s remarks, which echoed messaging from Russian President Vladimir Putin, were China’s most explicit so far in support of the Kremlin, reflecting a growing bond between the two countries’ governments and a shared opposition towards the United States. While not part of a formal alliance together, Beijing and Moscow have nurtured diplomatic and defensive ties into a strong partnership that looks set to deepen as Putin heads to China to hold a summit with Xi and attend the opening ceremony of the Beijing Olympics on February 4. Beyond watching the situation in Ukraine for opportunities to chide the United States and boost relations with Moscow, analysts say China also sees it as a crucial test for American resolve and the strength of transatlantic ties, which could have long-term consequences for how Beijing approaches its own geopolitical flash point in Taiwan. REF: RadioFreeEuropeRadioLiberty.org

5. Quant & Technical Corner – Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial markets and the investment environment.

5a. Most recent read on the Fear & Greed Index with data as of 01/31/2022 – 05:02 PM-ET is 38 (Fear). Last week’s data was 41 (Fear) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

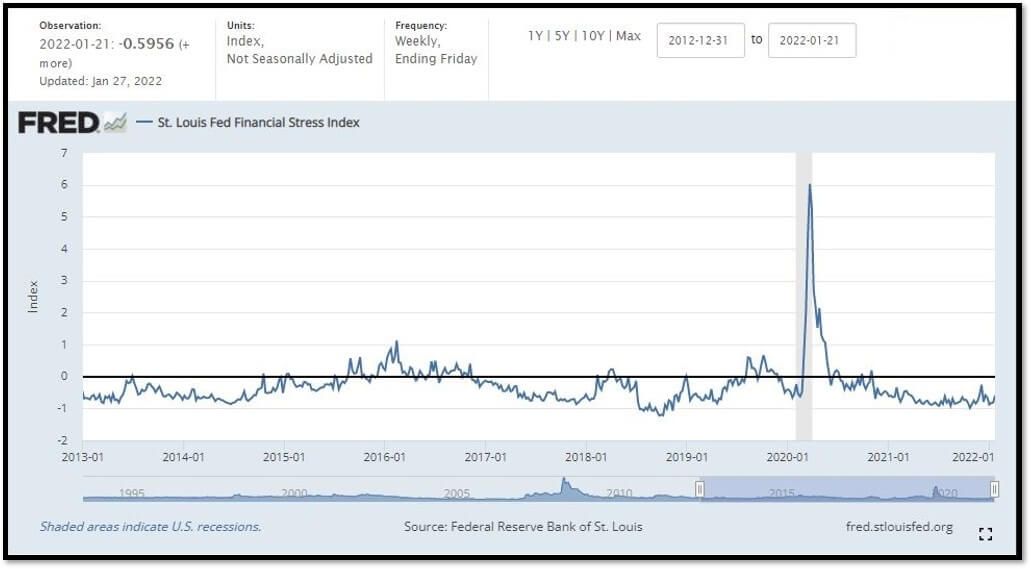

5b. St. Louis Fed Financial Stress Index’s (STLFSI3) most recent read is at -0.5956 as of January 27, 2022. Last week’s data was -0.8193. This weekly index is not seasonally adjusted. This (STLFSI3) index measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

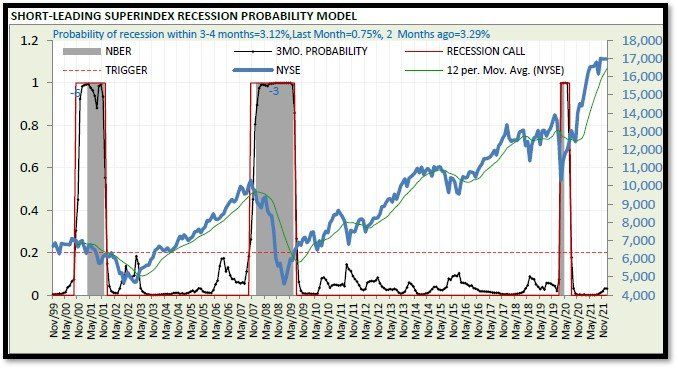

5c. Probability of U.S. falling into Recession within 3 to 4 months is currently at 3.12% (with data as of 01/31/2022). Last week’s data was at 1.14. Probability under 5% is considered extremely low. REF: RecessionAlertResearch

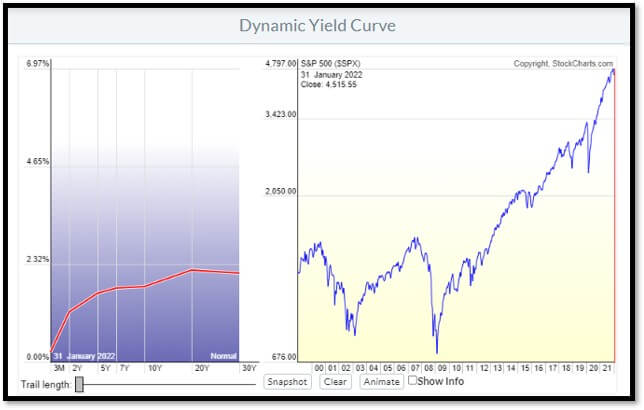

5d. Dynamic Yield Curve as of 01/31/2022 is Normal, Flattening on tail end. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

5e. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 1/31/2022, rates shown below are as of 1/31/2022, subject to change.

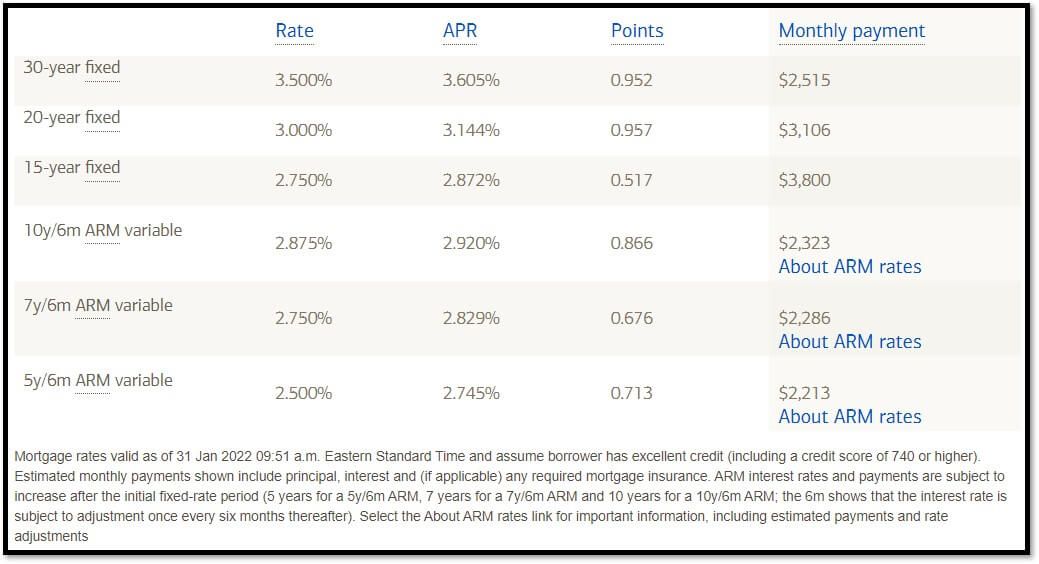

5f. Today’s Jumbo Mortgage Rates – (01/31/2022) Based on purchase of $700,000 home with $140,000 (20%) down payment in zip code 85054. Mortgage insurance may be required if down payment is less than 20%. Rates provided by Bank of America. REF: Today’sRateBankofAmerica

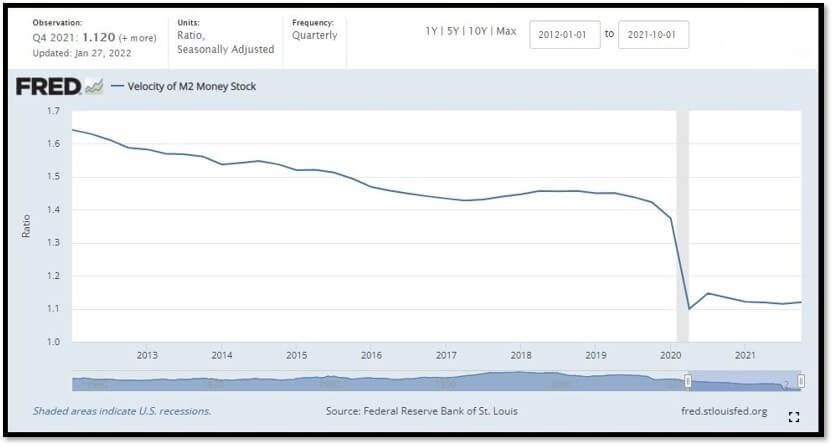

5g. Velocity of M2 Money Stock (M2V) with current read at 1.120 as of (Q4-2021 updated 01/27/2021). Previous quarter’s data was 1.115. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V, St.LouisFed-M2, MoneyStockMeausresReport

5h. In December, the Consumer Price Index for All Urban Consumers rose 0.5 percent, seasonally adjusted, and rose 7.0 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.6 percent in December (SA); up 5.5 percent over the year (NSA). January 2022 CPI data are scheduled to be released on February 10, 2022, at 8:30AM-ET. REF: BLS, BLS.GOV

5i. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Less Bearish on 01/31/2022 – REF: Short-term S&P500 by Marc Slavin

- Medium-term Chart: Falling on 01/31/2022 – REF: Medium-term S&P500 by Marc Slavin

- Market Timing Indicator – S&P500 Weekly – REF: Weekly S&P500 by Joanne Klein

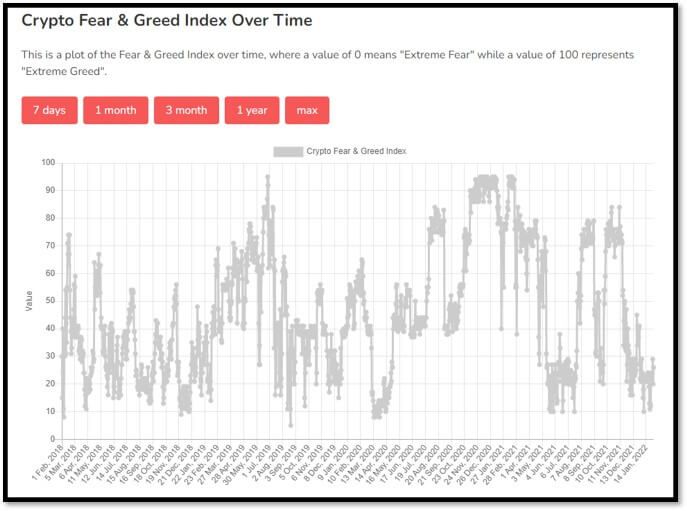

5j. Most recent read on the Crypto Fear & Greed Index with data as of 02/01/2022 is 26 (Fear). Last week’s data was 38 (Extreme Fear) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With our Fear and Greed Index, we try to save you from your own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, we analyze the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means "Extreme Fear", while 100 means "Extreme Greed". REF: Alternative.ME, CryptoFear&Greed

FOR INFORMATIONAL AND EDUCATIONAL USE ONLY

4655 Woodbine Road

Pace, FL 32571

(850) 995-1797

Turner Financial Group. (“TFG”) is an SEC-registered investment adviser firm. Such registration does not imply a certain level of skill or training. For a copy of TFG’s current Form ADV that includes a description of our services provided, fees charged, and other important information, please click here. For additional important disclosures, please click here.

Turner Financial Group | All Rights Reserved.